XRP Price Prediction: Will XRP Hit $3 Amid Technical Consolidation and Regulatory Momentum?

#XRP

- Technical Momentum: MACD bullish divergence and Bollinger Band positioning suggest upward pressure toward $3 resistance

- Regulatory Catalysts: ETF approval speculation and regulatory clarity providing fundamental support for price appreciation

- Institutional Adoption: Growing partnerships and tokenized asset initiatives strengthening XRP's utility and market position

XRP Price Prediction

XRP Technical Analysis: Critical Support Test Underway

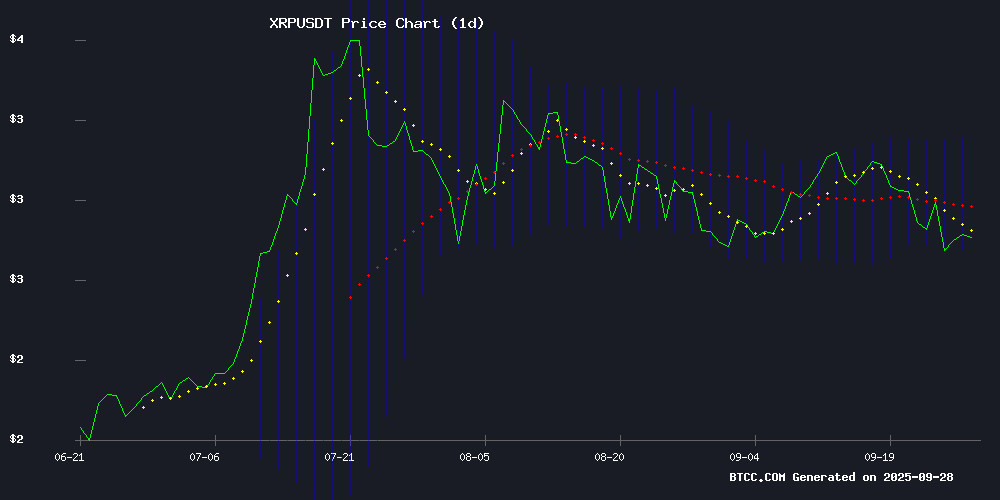

XRP is currently trading at $2.85, slightly below its 20-day moving average of $2.96, indicating potential short-term resistance. The MACD indicator shows bullish momentum with a positive histogram reading of 0.0773, suggesting upward pressure may continue. However, the price is testing crucial support levels NEAR the Bollinger Band lower boundary at $2.74.

According to BTCC financial analyst Michael, 'The current technical setup shows XRP is at a pivotal juncture. Holding above the $2.73 support level could pave the way for a retest of the $3.00 psychological barrier. The MACD's positive divergence indicates underlying strength, but traders should watch the Bollinger Band squeeze for breakout signals.'

XRP Market Sentiment: Regulatory Progress Fuels Optimism

Market sentiment for XRP appears cautiously optimistic as regulatory clarity and ETF speculation dominate headlines. Recent partnerships with institutions like ONDO Finance for tokenized treasuries demonstrate growing institutional adoption, while analyst predictions of $10 by 2027 reflect long-term confidence.

BTCC financial analyst Michael notes, 'The combination of potential ETF approvals and Ripple's institutional DeFi initiatives creates a fundamentally stronger backdrop for XRP. While short-term volatility persists, the regulatory progress and partnership announcements provide solid foundations for sustained growth beyond the $3 threshold.'

Factors Influencing XRP's Price

XRP Price Prediction: Analysts Forecast $10 by 2027 Amid Regulatory Clarity and ETF Rumors

Ripple's XRP has emerged as one of 2025's top crypto performers, currently trading between $2 and $3 and ranking third by market capitalization. Analysts attribute this momentum to regulatory clarity in the U.S., particularly the GENIUS Act, and anticipate Ripple's stablecoin launch could further bolster the token's prospects.

Market watchers are eyeing a potential $10 valuation by 2027, citing upcoming payment system expansions and growing speculation about XRP ETF approval. Such institutional adoption WOULD mirror Ethereum's trajectory, potentially driving significant price appreciation.

The token currently trades at $2.78 after retreating from $3.20 during recent market volatility. Crypto analyst Ali Martinez identifies $2.70 as critical support—maintaining this level could pave the way for a rebound toward previous highs.

XRP Price Projections: Path to Millionaire Status by 2030?

Ripple's XRP has emerged as a focal point in cryptocurrency markets, currently trading at $2.80. The asset's strategic partnerships with global financial institutions and potential SEC approval for an ETF are fueling investor optimism.

Analysts project significant price appreciation through 2030, with Changelly forecasting XRP could reach $26 by the decade's end. Such growth would transform monthly investments of 100 XRP into substantial holdings, though achieving millionaire status depends on both market conditions and initial investment amounts.

The cross-border payment specialist's foray into stablecoins and continued institutional adoption suggest long-term viability. Market watchers note XRP's current price point offers accessible entry for strategic accumulation.

XRP's Market Trajectory and Institutional Adoption

XRP (-0.18%), the third-largest cryptocurrency by market capitalization, has emerged as a standout performer in the digital asset space since the 2016 U.S. presidential election. The cryptocurrency benefited from a regulatory tailwind following the appointment of a new SEC chair, which led to the dismissal of a longstanding lawsuit against Ripple. This resolution cleared the path for Ripple's ambitious plans, including a spot XRP ETF and ecosystem expansion.

Ripple's technology positions XRP as a potential disruptor in cross-border payments, with CEO Brad Garlinghouse envisioning it as a challenger to SWIFT. The network's ability to provide instant liquidity could reshape how financial institutions manage reserves and pre-funded accounts. Institutional adoption is accelerating as regulatory uncertainty diminishes, bridging the gap between traditional finance and crypto innovation.

XRP Price Prediction: Analysts Compare Remittix to Early Ripple Opportunity

Ripple's XRP, once overlooked at $0.03, now trades near $3.00 as analysts eye a potential breakout toward $4.50-$5.00 by late 2025. The token faces critical resistance at $3.20-$3.30, with support holding at $2.80. "Buying Remittix now is like snapping up Ripple at $0.03," claims one expert, drawing parallels between the emerging PayFi project and XRP's early days.

ETF speculation and Ripple's expanding payment network fuel bullish sentiment, though institutional adoption remains the key variable. Optimistic scenarios project $7-$8 targets should macro conditions align, while $2.30-$2.50 emerges as a downside risk zone. Market participants await clarity on regulatory hurdles that continue to weigh on XRP's upside potential.

XRP Price Prediction: First US Spot ETF Nears Approval Amid $5 Target Speculation

Cryptocurrency markets are buzzing as XRP takes center stage with the anticipated launch of the first U.S. spot ETF. Analysts project a potential surge to $5, fueled by renewed institutional interest and bullish sentiment.

Parallel to this development, a new green mining initiative emerges. MSP Miner's mobile app leverages renewable energy sources, offering low-barrier entry to XRP mining. The platform combines energy-efficient algorithms with wind and solar power, aligning with global sustainability trends.

Security remains paramount with MSP Miner's infrastructure. Cold wallet storage, McAfee® protection, and enterprise-grade encryption safeguard user assets. The platform eliminates traditional mining hurdles—no hardware requirements or technical expertise needed.

Ripple’s Vision for Institutional DeFi Is Taking Shape Fast on XRP Ledger

Ripple is accelerating institutional DeFi adoption as the XRP Ledger achieves $1 billion in monthly stablecoin volumes. The platform is unlocking real-world asset momentum and building compliant blockchain credit infrastructure.

The XRP Ledger has entered its most ambitious phase yet, with Ripple driving institutional participation. This development signals growing confidence in blockchain-based financial solutions among traditional finance players.

XRP Faces Critical Support Test Amid Market Turbulence

Ripple's XRP hovers NEAR a decisive $2.70 support level after a 10% drop from its September peak of $3.20. The token's failure to hold the $3 psychological threshold has intensified bearish pressure, with technical indicators flashing warning signs.

Market sentiment appears divided as AI analytics tools offer conflicting outlooks. ChatGPT flags XRP as a 'strong sell' based on technical setups, while Grok's assessment remains partially redacted. The Fed's 2025 rate cut initially buoyed crypto markets, but the rally proved ephemeral.

September's downturn mirrors broader crypto weakness, though some analysts see rebound potential if $2.70 holds. 'This level represents make-or-break for XRP's near-term trajectory,' noted one trader, speaking on condition of anonymity.

XRP Faces Critical Technical Level At $2.73 — Why It Matters

XRP has slipped below the psychological $3 support level, shedding 7.02% of its value over the past week. The altcoin now consolidates between $2.78 and $2.79, failing to retest the newly formed resistance. On-chain data reveals a precarious support zone that could dictate its near-term trajectory.

Crypto analyst Ali Martinez identified a price gap between $2.73 and $2.51 using the UTXO Realized Price Distribution metric. This gap represents a thin trading volume area with minimal support or resistance. A breakdown below $2.73 could trigger accelerated selling pressure, given the lack of historical activity in this range.

The URPD metric highlights XRP's transaction history relative to its all-time high, mapping potential turning points. Current price action hovers near the upper boundary of this danger zone, putting bulls on high alert. Market participants await either a firm rejection or breakdown to determine the next directional move.

Ripple (XRP) Faces Reality Check After Volatile Rally

Ripple's XRP (0.70%) has demonstrated explosive volatility, surging 580% between November 2024 and January 2025 before nearly doubling again this summer to $3.65. The token now struggles below $3, down over the past month, raising questions about its ability to regain momentum.

The XRP Ledger's promised disruption of SWIFT's cross-border payment network remains unrealized. While proponents highlight its near-instant settlement and cost advantages over legacy systems, concrete adoption by financial institutions has failed to materialize. Market enthusiasm continues to outpace real-world utility.

Ripple and Ondo Finance Partner to Bring Tokenized U.S. Treasuries to XRP Ledger

Ripple has announced a collaboration with ONDO Finance to integrate tokenized U.S. Treasuries (OUSG) into the XRP Ledger (XRPL). The partnership aims to enhance liquidity and transaction speed while bridging traditional finance with blockchain technology. Ondo Finance's OUSG, which boasts over $690 million in total value locked (TVL), will provide institutional users with compliant, composable assets for decentralized finance (DeFi) applications.

Ian De Bode, Chief Strategy Officer at Ondo Finance, emphasized that the integration, which includes RLUSD as a settlement option, expands access to high-quality on-chain financial instruments. Markus Infanger, Senior Vice President at RippleX, highlighted the initiative as a milestone in the maturation of tokenized finance, offering institutions a compliant way to hold Treasuries on-chain.

With $1.3 billion in TVL, Ondo Finance continues to lead in real-world asset (RWA) tokenization, further solidifying the convergence of traditional finance and DeFi.

Will XRP Price Hit 3?

Based on current technical indicators and market developments, XRP has a strong probability of reaching $3 in the near term. The current price of $2.85 is approximately 5% away from the $3 target, with several supportive factors aligning.

| Factor | Current Status | Impact on $3 Target |

|---|---|---|

| Technical Position | $2.85 (near 20-day MA) | Moderate Bullish |

| MACD Signal | Positive 0.0773 | Bullish |

| Key Support | $2.73-2.74 range | Critical for uptrend |

| Market Sentiment | ETF speculation + partnerships | Strongly Bullish |

| Regulatory Environment | Improving clarity | Long-term Positive |

BTCC financial analyst Michael emphasizes that 'The convergence of technical rebound potential from current levels and fundamental catalysts from regulatory developments creates favorable conditions for XRP to challenge the $3 resistance. However, traders should monitor the $2.73 support level closely, as any breakdown could delay the upward move.'